Price Elasticity

Note that while price elasticity is related to the slope of the line, it is not actually the slope of the line.

Recall that the slope of the line is calculated by "rise over run," or the change in the y-axis divided by the change in the x-axis.

Price elasticity is calculated by "run over rise," or the change in quantity (on the x-axis) divided by the change in price (on the y-axis).

Recall that the slope of the line is calculated by "rise over run," or the change in the y-axis divided by the change in the x-axis.

Price elasticity is calculated by "run over rise," or the change in quantity (on the x-axis) divided by the change in price (on the y-axis).

Generally, a curve is elastic if it is flat and more inelastic if it is more verticle. However, this can be a little misleading.

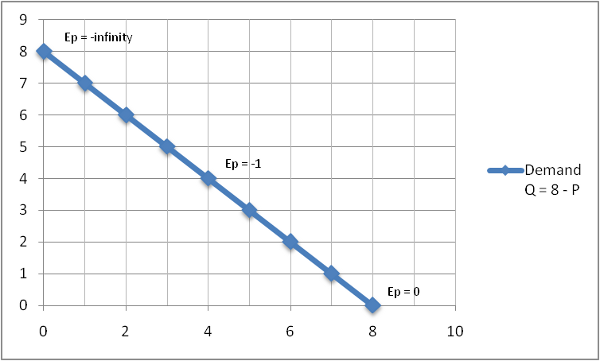

Even on a linear (straight) demand or supply curve, the elasticity is not constant for the whole curve. The reason for this is that we are measuring the percentage change in both price and quantity. As you move along a linear curve and approach one of the axes, the percentage changes in that axis variable (either price or quantity) get smaller and smaller and the percentage changes of the opposite axis get bigger and bigger.

Price elasticity does NOT have a unit attached to it. That is, price elasticity is not measured in dollars or %, it is simply a ratio.

Price Elasticity of Demand

The first law of demand states that as price increases, less quantity is demanded. This is why the demand curve slopes down to the right. Because price and quantity move in opposite directions on the demand curve, the price elasticity of demand is always negative.

The image below shows the price elasticity of demand at different points along a simple linear demand curve, QD = 8 - P.